Digital Crisis management is hard work. It’s complicated work. But it’s also not rocket science once you understand the mechanics of the process. Today, let’s break down crisis management into five simple components (or phases) and briefly explore the structure of each one. Understanding how to break down a digital crisis management model that way, looking at what types of tools to use and how, and going through a few general observations in regards to best practices will hopefully arm you with helpful guidelines should your organization ever find itself having to deal with… an unfortunate circumstance involving a lot of very angry people.

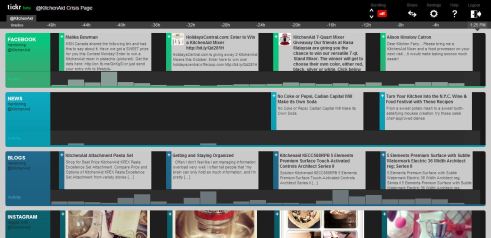

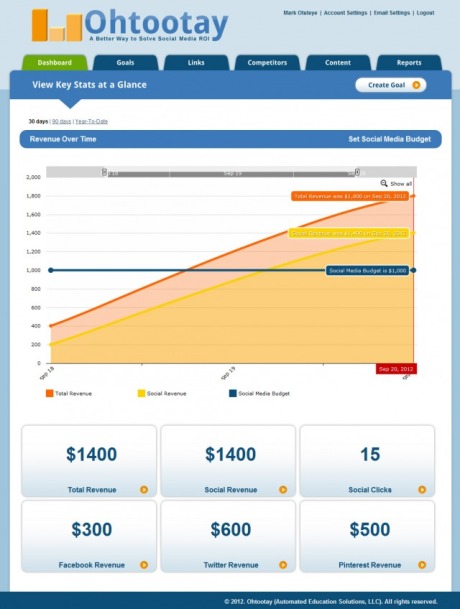

To illustrate how this works, we will look at screen shots of what @KitchenAid’s recent PR crisis looked like on our own dashboard. If you aren’t familiar with what happened and what the crisis was about, you can catch up here (just remember to come back).

Let’s start at the beginning:

1. Discovery

One of the purposes of digital monitoring is to serve as an early warning system for PR crises. Every company should monitor social channels and news media for signs of a possible attack on their brand. The earlier a potential problem is detected, the faster it can be dealt with. It’s that simple. The question you want to ask yourself here is this: Do I want to be able to start working on fixing a PR crisis while it is still young, small, and easy to manage, or do I want to start working on it tomorrow, when it has already snowballed into a news story already being covered by CNN and the New York Times?

The more vigilant you are, the easier it will be to avoid major PR disasters. It really isn’t complicated. And thanks to modern digital tools, all it takes to set up an early warning system for your company is the will to do so, and a little bit of forward thinking on the part of your brand or product management team. (If you don’t want to do it internally, you can easily work with your agency of record to set something up.)

In the case of KitchenAid, the crisis was identified early. This allowed management to start working on it in that first hour, which is critical given that Mashable first reported on the incident about an hour after it happened.) Speed matters.

2. Analysis

What does a budding PR crisis look like? What should you look for? How do you spot an avalanche before it starts coming down the mountain? It’s all actually quite simple. And… don’t think of it as an avalanche. Avalanches strike too hard and too fast. PR crises, for the most part, are more like waves. In regards to digital reputation management and crisis monitoring, fancy yourself more a surfer than an alpinist: along a timeline, crises look like waves. They’re swells. Your job, as a digital/crisis monitoring professional, is to watch the horizon for the next set of waves. Some waves are great. Some waves are dangerous. The trick is to learn which is which. (The metaphor stops here.) Here are some things to look for:

-

- A sudden increase in volume of mentions.

- A sudden increase in the number of retweets (RT).

- A sudden change in sentiment (especially is the shift moves towards the red/negative.)

- If you are using word cloud analysis alongside brand or product mentions to create context, watch for the appearance (and growth) of particular topics.

- If one or more of your monitoring tools allow it, dig into the mentions, especially those that are negative, and see what people are talking about. On Twitter, pay particular attention to retweets. In the early phases of a PR crisis, people will be more likely to share a screenshot, a hyperlink to a blog post or a video than at any other point during the crisis. Chances are that whatever they are sharing will take you to the root cause of the crisis itself.

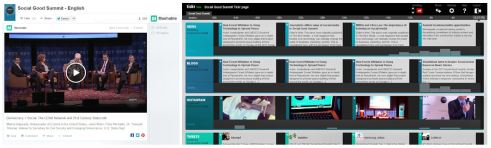

Note that in the KitchenAid example (see image above), blogs and social media channels were on to the crisis a lot more quickly than news organizations. The content window showing a Facebook conversation (orange circle) clearly focuses on the Twitter snafu, while the stream showing news item (green circle) still hasn’t caught up with the developing story. Multi-channel monitoring is key to spotting problems early and being able to dig into what is being said and why.

3. Response

How a company first responds to a crisis will set the stage for everything that comes afterwards. There is no room whatsoever for a faux pas. Incidentally, waiting to respond or not doing anything is a faux pas. The good old days of releasing a press release or statement in a day or two are gone. You now have under an hour to start responding to a crisis. If you really want to be on top of a crisis, you want to begin responding in under ten minutes.

Here is a quick primer on how to respond to a crisis quickly and effectively:

- Introduce yourself. Use your name and your title.

- Frame the situation for the public. State the facts. What happened? When did it happen? What is your position? Apologize of you need to. Don’t spin. Don’t lie. Establish trust and leadership.

- Communicate to the public what comes next and what they should expect.

- Communicate to the press the response schedule and structure, and the means by which they should obtain information from you.

- Communicate developments and milestones with the public as they happen (the frequency will depend on the crisis). Err on the side of giving them too many updates. Make them feel that you are dedicated to fixing the problem in the most expedient and transparent way possible.

To KitchenAid’s credit, this process is precisely the one that was used by Cynthia Soledad and the company’s crisis team, and it worked.

4. Management

This part involves most of the heavy lifting. The crisis will hit its peak in this phase, so the volume of mentions will be higher than it has been in any of the previous phases.

How a company manages a crisis depends on a number of things: the crisis itself (type, gravity, potential market impact, etc.), its degree of preparation for such a crisis, its internal capabilities (technical, manpower, training, fluency), and its culture.

I should point out that it isn’t enough to take the pressure out of the balloon, so to speak. It has to be done properly, and in a way that makes sense for the brand. A simple way of looking at this: Say that Nike and Starbucks were to find themselves with a very similar crisis. And say that for the sake of argument, each of these companies had precisely the same degree of preparation, the same general guidelines, internal capabilities, fluency with crisis management, etc. One might expect that even with all of these similarities, Nike and Starbucks would respond their crisis differently. Why? Because each company enjoys a unique culture, a unique style of public outreach. Each company’s relationship with the public (some of who are fans and customers, while others are neither) is uniquely its own.

In that light, what is most important during the management phase isn’t necessarily to have a crisis management plan (though having one would certainly help), but rather to have a thorough understanding of how to defuse public outrage, anger, criticism, even hatred, do so in a way that makes sense for the brand, and get through that process without antagonizing anyone. Companies have to walk a very fine line between defending itself and being in any way antagonistic. This requires that everyone on the crisis management team keep a cool head. No one can ever lose their temper. No one can get sucked into a public argument.

A note on internet trolls: Pay them no mind. As much as they may amplify negative sentiment during a PR crisis, trolls can only affect public opinion if they are given the power to do so. That power knows only one fuel: attention. The less attention a company’s crisis management team gives a troll, the less impact he or she will have on the direction, volume and duration of the crisis. It isn’t to say that trolls don’t, on occasion, need to be confronted and dealt with, but the management phase of a PR crisis is not one of those times. During this phase, a troll is just a voice in the crowd, trying to shout louder than anyone else. Try as they may, trolls can’t make waves in the middle of a storm. Remember that.

Control the message. Control the situation. Don’t get sidetracked by anyone whose aim is to distract you from your job.

There are essentially to main pieces to the management phase. The first is a continuation of the “update the public” function that began in the response phase. This can involve the creation of a crisis page and a Twitter account alongside existing communications channels. (BP did this during the Deep Sea Horizon crisis.) The second is the direct interaction between the company and the public across social platforms. That is where community management, the creation of discussion groups and tabs, the publishing of fact sheets becomes very important. In some cases, (like the posting of an offensive tweet) a quick explanation of what happened and an apology will do the job. In other instances, the problem goes far deeper than that and will require more work.

Examples: An investigation by a major news organization just uncovered that your company employs child labor in a number of countries around the world. A report from a global ecological watchdog paints your company as being a major source of air or water pollution. Your CEO has just found himself connected to a damaging corruption scandal. The batteries in your latest device can explode and injure your customers. (Things that won’t go away with an apology.)

By engaging with the public and listening to their complaints, a company can identify key topics they need to focus on. These topics will frame the conversation that the public ultimately wants to have with the company. The more focus exchanges have, the more likely it is that they can be shifted from pointless noise to purposeful signal.

Once a company has identified topics and themes, it can dig deeper and identify specific complaints that relate to them. Once these complaints have been clarified, the discussion process can now be shifted from conflict to collaboration. Remember that every complaint simply identifies a problem. Once a problem is identified, all the company has to do is acknowledge it, drill down into the details of the complaints around it, and ask the public how it would solve it. In doing so, the company’s relationship with the public shifts from one of conflict to one of collaboration.

The next step is to come to an agreement with the public as to what should be done about the problem, and how to move towards some measure of resolution that makes sense for everyone. Rededicate your company to fixing the problem, even if the best you can realistically offer is an incremental process that could take years. Make this a new point of focus for your company – an initiative. Pledge to work on this, and make it happen. Recruit the help of the public. Partner with them. Make them part owners of the solution. reward them for their help.

We could write a whole book on this topic, so it’s probably best to stop here… or this could turn into a VERY long blog post.

5. Post-crisis monitoring & advocacy

This part is simply the follow-through. Now that the crisis itself has ended, it’s time to button things up. What did you miss? What did you learn? What comes next?

Don’t let the deflation of the wave of mentions be your only guide. News cycles are short-lived nowadays. People will grow bored of a scandal or PR crisis after a few short days, no matter how effective a company was at addressing and managing it. Just because people have moved on to another topic doesn’t mean that your troubles are over. Don’t mistake changes in the volume of mentions for resolution.

If the root cause of the crisis was not resolved, it will stick. It will become part of the brand’s story. It may even become the defining feature of the brand for years to come – a stain on its reputation that won’t easily go away once it grows roots. You don’t want that. A crisis can’t just go away. It has to be resolved.

The only way to find out if it has been resolved or if it has just gone away for a while is to monitor conversations about the brand once the crisis has subsided. There is a short term piece to this, and there is a long term piece as well. You want to gauge the impact of what you’ve done, and make adjustments along the way until you can be certain that the crisis, its cause, and the expectations of the public have been worked through. Once that has been done, look for people who are not aware that you have resolved the problem, and politely, kindly engage them. Show them the progress you’ve made. Link to what you have done and what you are doing. Inform, inform, inform. Whom you inform, when, how and why can’t happen in a vacuum. Monitoring for specific types of opinions and conversations can help you target the right people at the right time with the right information. This allows you to get your message across quickly and effectively without requiring major media buys and hit-or-miss campaigns. Think major cost-savings, sure, but think also of speed and effectiveness.

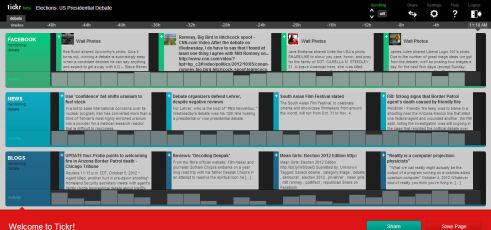

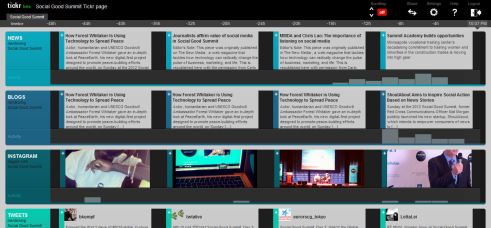

To close our example, a quick look at the @KitchenAid crisis Tickr page two weeks after the incident shows no significant activity that might suggest a resurgence of the crisis. Digging a little deeper, we see that conversations have shifted from the incident to more routine, benign topics about the brand and its products.

How is that for using Tickr as a PR crisis overwatch platform? Not everything about digital monitoring and crisis management has to be complicated. We like to make things easier for everyone. It’s what we do,

As always, we would love to hear your comments, especially if you have PR crisis stories to share with us. What happened? What did you do? What did you learn in the process? Do you have any questions? Can we shed some light on anything? (Process, technology, best practices?) The comments section is all yours.

We’re also on Facebook and Twitter, so we can have that discussion there as well.

And if you aren’t using Tickr to monitor the web yet (social or not), you can start using the basic version for free in just a few minutes. (If you need more features or more horsepower, the Pro and Enterprise versions don’t take much longer to set up either .) Start here.